Factors to Consider When Investing in Stocks

Investing in stocks or simply stock investment is a risky and slippery field, especially for new investors. But while it may sound intimidating, the earning is quite simple and cuts across the board; buy stock at a low price and sell at a higher price. While the road to profit is predefined, a significant gamble lies in selecting individual stocks for investment.

The backbone of any successful stock investment strategy is research – in this case, market research. It is highly recommended to do enough homework before deciding where to put your hard-earned cash, with the main objective being to maximize returns from your investment.

What is a Stock?

A stock refers to a security that represents fractional ownership in a company or corporation. Stocks come in small bits called shares which are traded on the stock market exchange. Companies seeking funding list their shares on the stock market exchange, which tracks the supply and demand of individual company stock and determines share price.

Stock investment is mainly driven by a profit motive where investors buy stock in companies they think will appreciate in value. If a company’s value goes up, its shares also appreciate, and investors can sell at a profit. A share entitles its holder to the company’s profits based on the number of shares held.

Factors to Consider When Investing in Stock

Below are factors that an investor needs to consider when venturing into stock investment;

1. Have an Investment Roadmap

An investment roadmap is a detailed financial plan that outlines an investor’s financial objectives and how to achieve them. Your personalized investment roadmap should seek to achieve two main objectives – attain optimal returns and minimize risk.

Having an investment roadmap will help you identify and draw up an appropriate investment strategy. It helps you diversify your investment and become more risk-tolerant by facilitating asset allocation. With an investment roadmap, you can easily evaluate your performance on a regular basis and rebalance your portfolio periodically to align with your investment needs.

An investment strategy sets the boundaries under which an investor operates when making investment decisions. By setting such strict guidelines, an investment strategy helps remove the guesswork and emotion out of an investment equation. There are three main strategies that investors follow when making stock investment decisions;

- Value investing – this strategy focuses on stocks that are projected to appreciate in value. It targets stocks that are deemed to be undervalued relative to their peers with the hope of cashing in on price rice when investors catch up with the opportunity.

- Growth Investing – the strategy focuses on stocks that have shown outstanding market performance in terms of earnings, revenue, and price appreciation over a period of time. Investors view these upward trends as pointers of growing interest in the company and its products or services and are opportunities to generate outsize gains.

- Income investing – income investing focuses on stocks that are known for paying high dividends. These dividends are signs of growth and also generate passive income for investors regardless of share price performance.

2. Determine Your Time Horizon

An investment time horizon is a period through which an investor expects to hold on to an investment instrument before disposing it off. Time horizon is usually outlined in an investor’s investment strategies and goals.

There are three main investment time horizons;

- Short-term Investment Horizon –this refers to an investment expected to mature within a five-year timeframe. These investment products are good for investors seeking a large sum of money in the near future or even seniors approaching retirement age. Examples of short-term investments include savings accounts, money markets, short-term bonds, and certificates of deposit.

- Medium-term investment horizon – these are investment products held for between three to ten years. They usually include a mix of both high- and low-risk investment products and savings for marriage, college, and a home. Medium-term investment products can also include a mix of stock and bonds and are suitable for portfolio diversification which is key to increasing returns and minimizing risks.

- Long-term investment horizon – it refers to investments that have a maturity of more than ten years. They are preferred by investors with long-term financial objectives like saving for retirement. These investments can put up with greater risks in return for greater rewards.

Among other things, time horizon is helpful when evaluating the risk level. The various types of risks that are determined by time include inflationary risk, interest rate risk, business risk, default risk, and market risk.

3. Look at the various Ratios

Financial ratios are parameters that compare two or more financial variables using data drawn from the company’s financial statements. They help offer a summary view of the company or market performance by looking at things like liquidity, coverage, solvency, profitability, efficiency, and market prospects.

Important ratios to work with include;

- Price-to-Earnings Ratio (P/E Ratio) – this ratio compares the price of a stock to the company’s per-share earnings (EPS). This ratio values the company by measuring the current share price in relation to the company’s earnings per share.

- Debt to Equity Ratio – the debt-to-equity ratio measures how much of a company’s equity earnings is used to service the company’s debt. It evaluates the company’s financial leverage and is obtained by dividing the total liabilities by the company’s equity.

- Price-to-Book-Value Ratio (P/B Ratio) – this ratio compares the company’s market size/capitalization to its book value. We calculate the P/B ratio by dividing the stock price per share by the company’s book value per share.

Financial ratios help investors and entrepreneurs to evaluate the company’s performance relative to similar businesses in the industry. The ratios also compare the company’s performance during different periods.

4. Consider Portfolio Diversification

Portfolio diversification is an investment strategy that involves blending different investment products into one portfolio. The strategy helps to lower risks and yield higher returns.

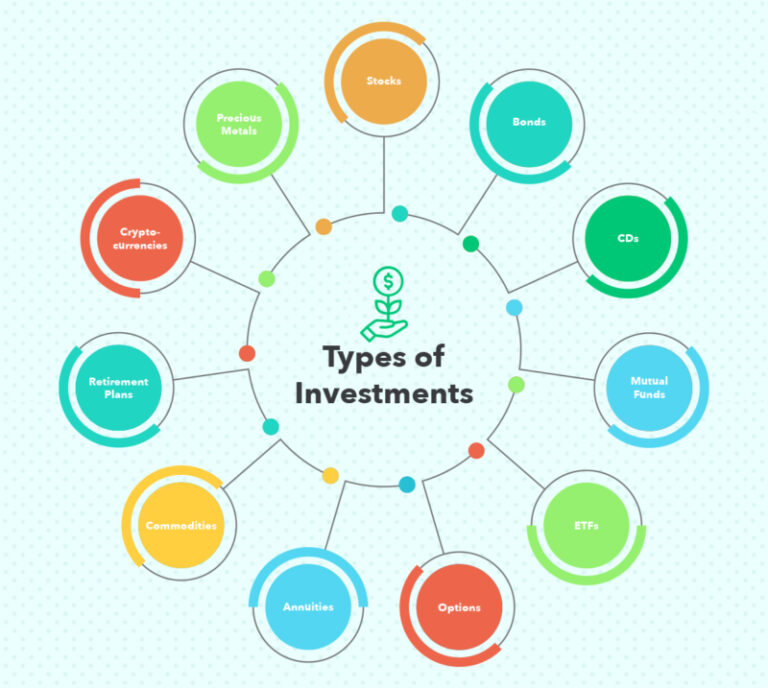

Diversification may involve investing in stocks from different companies, industries, and risk levels. It also involves investing in different investment products like real estate, stock, commodities, and bonds.

Investors use diversification to reduce both systematic and market risks. Systematic risks include exchange rates, inflation, interest rates, political instability, war and unrest. Market risks include financial risks and business risks and are caused by market events and fluctuations.

5. Net Margins

The net margin of a company is its net income per sale. This ratio shows how easy and efficient it is to get profit from sales. An investor needs to put in enough time to research the net margin of each potential company in order to select those with a promising future.

Net margin is sometimes called the business’ bottom line because it gets down to the core of how the business is operated. The margin looks beyond revenue and gives a clear picture of the business is generating profit from its revenues.

It is advisable to have a higher positive net margin as this shows the business is profitable. On the other hand, a negative net margin shows the business is in a bad state financially.

Bottom Line

While market research is time-consuming and exhaustive, it is a great asset in protecting your investment and increasing yields. One of the business mistakes you are likely to make as an investor is to put your money in a company simply because you know its name. Stock investment is a high-risk area that calls for sufficient investment experience and in-depth market research.