Investing in Gold: A Beginners Guide

Investing in gold is a popular way to diversify one’s portfolio and potentially protect against inflation. Gold has been considered a store of value for centuries and is often seen as a safe haven asset during times of economic uncertainty. Investing in gold can be considered a relatively safe investment, as it tends to have a low correlation with other assets and can potentially protect against inflation. However, like any investment, there are risks involved.

The price of gold can fluctuate significantly depending on a variety of factors, such as interest rates, currency fluctuations, and global political and economic events. Investing in physical gold also involves the added risk of theft or loss.

Additionally, gold mining stocks are subject to the risks associated with the mining industry, such as changes in commodity prices, regulatory changes, and operational risks. As with any investment, it is important to conduct thorough research and consider one’s own risk tolerance before investing in gold.

Why Invest In Gold

There are several reasons why investors may choose to invest in gold:

Diversification

Diversification is the process of spreading investments across different asset classes, sectors and geographies to reduce overall portfolio risk. Gold has a low correlation with other assets, such as stocks and bonds, which means that the price of gold may not move in the same direction as other assets in a portfolio. This can potentially reduce overall portfolio risk and help to protect against market volatility.

For example, when stock markets are declining, the price of gold may rise, providing a buffer for the overall portfolio. This can help to mitigate the negative impact of market downturns on an investor’s portfolio. In addition, gold has historically shown to be less volatile than other assets, such as stocks, which can be beneficial for investors who are looking for a more stable form of investment.

Hedge against inflation

Gold is often seen as a hedge against inflation because it has the potential to maintain or increase in value as the cost of goods and services rise over time. Inflation erodes the purchasing power of an investment, as the same amount of money can buy less in the future than it can today. Gold, on the other hand, has held its value over long periods of time and can potentially preserve the purchasing power of an investment.

As the prices of goods and services rise, the demand for gold may also increase, which can push up the price of gold. This can help to offset the negative impact of inflation on an investor’s portfolio. Additionally, gold is a tangible asset and it’s not dependent on any single country or economy, which can provide a level of stability during times of economic uncertainty.

Safe Haven Asset

Gold is considered a safe haven asset because it tends to hold its value during times of economic uncertainty or market volatility. Safe haven assets are investments that are expected to hold their value or increase in value during times of market stress. Investors may turn to these assets as a way to protect their wealth during these periods.

During times of market uncertainty, investors may become more risk-averse and may seek out investments that are less likely to be affected by market fluctuations. Gold, as a tangible asset and store of value, has historically been seen as a reliable investment during times of uncertainty. The demand for gold can increase during periods of market stress, which can push up the price of gold.

Additionally, gold is not dependent on any single country or economy, which can provide a level of stability during times of economic uncertainty. It’s also important to note that gold is not correlated with other assets, such as stocks and bonds, which means that the price of gold may not move in the same direction as other assets in a portfolio.

Store of Value

Gold has been considered a store of value for centuries and has held its value over long periods of time. This can make it an attractive investment for those looking to preserve the purchasing power of their wealth.

The value of gold is not dependent on the performance of a particular company or economy. It is a tangible asset that does not have counterparty risk, and it’s widely recognized and accepted as a store of value globally. This means that gold can potentially maintain its value over time, even during periods of economic or political instability.

In addition, gold can act as a hedge against currency devaluation. The value of gold is denominated in US dollars, but since gold is a global commodity, it’s value is not tied to the value of any specific currency, which can make it an attractive investment during times of currency devaluation.

Liquidity

Liquidity refers to an asset’s ability to be easily bought and sold in the market without a significant impact on its price. Gold is considered to be a liquid asset because it can be easily bought and sold on the market, and it’s an asset that can be easily converted into cash.

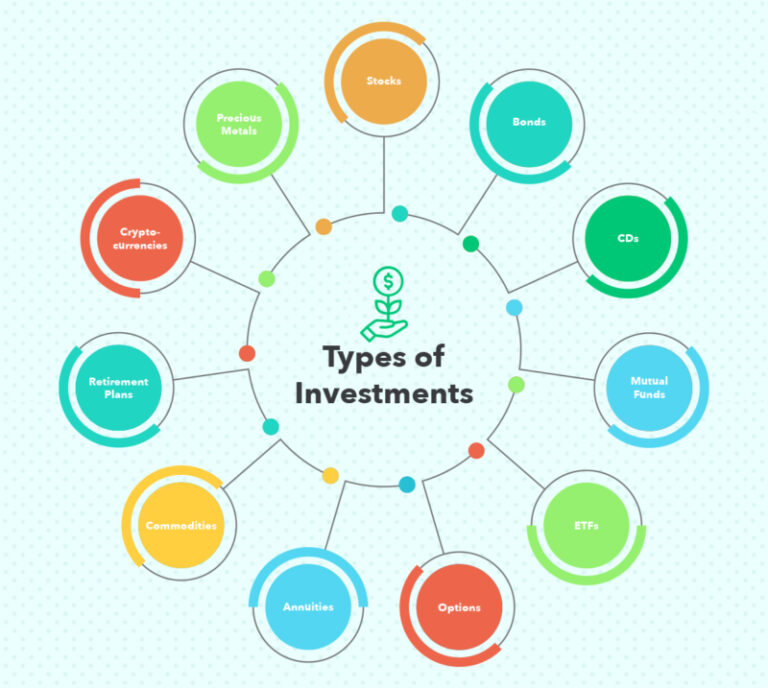

Gold can be traded in a variety of forms, including physical gold, gold ETFs, mining stocks, and futures and options contracts. This makes it easy for investors to buy and sell gold at a fair market value, without the need for storage or insurance.

Additionally, gold has a global market, which means that it can be easily traded across borders, making it an attractive investment for those looking for a liquid asset that can be easily converted into cash. It’s also important to note that gold can be traded 24/7, which can be beneficial for investors who want to have the ability to buy or sell at any time.

How to Invest in Gold?

Below are the different ways to invest in gold:

Physical Gold

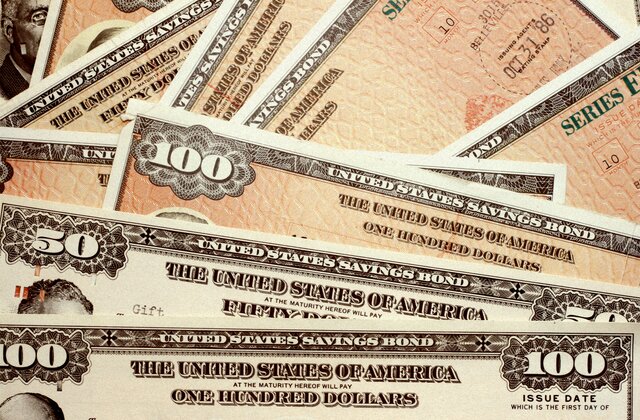

Investing in physical gold refers to buying and owning physical gold in the form of coins, bars, or jewelry. This can be a tangible way to invest in gold and can offer the potential for long-term appreciation in value.

One of the most popular forms of physical gold investment is gold bullion coins. These coins are produced by government mints and are made of gold that is at least 91.67% pure. Some examples of popular gold bullion coins include the American Gold Eagle, Canadian Gold Maple Leaf, and the South African Gold Krugerrand.

Another way to invest in physical gold is through gold bars. These are typically available in sizes ranging from 1 ounce to 400 ounces and can be a cost-effective way to purchase large amounts of gold.

Gold jewelry can also be considered a form of physical gold investment. However, it is important to note that the value of gold jewelry is often based on more than just the weight and purity of the gold. Factors such as craftsmanship, design, and brand can also affect the value of the jewelry.

Gold exchange-traded funds (ETFs)

A gold exchange-traded fund (ETF) is a type of investment vehicle that holds physical gold and can be bought and sold on stock exchanges. ETFs allow investors to gain exposure to the price of gold without the need to physically own or store the metal.

An ETF is a type of fund that holds a basket of assets, such as stocks, bonds, commodities, or currencies, and it’s traded on stock exchanges, meaning that the price of the ETF shares can fluctuate throughout the day as it’s traded by investors.

When it comes to Gold ETFs, they are backed by physical gold, which is held by the fund in a vault. The ETFs are bought and sold on stock exchanges just like stocks, and the price of the ETF is closely tied to the price of gold.

When an investor buys shares of a gold ETF, they are buying an interest in the physical gold held by the fund. The value of the ETF is based on the value of the underlying gold, which is determined by the spot price of gold. As the price of gold changes, the value of the ETF also changes.

Gold ETFs have some advantages over physical gold investment, such as liquidity, as ETFs can be easily bought and sold on stock exchanges, and the ease of buying and selling shares, as well as the possibility of using margin or leverage, which can be useful for some investors. However, it’s important to note that ETFs also have management fees, which can affect the returns on the investment.

It’s important to conduct thorough research before investing in a gold ETF, as different ETFs may have different expense ratios, holding, and tracking errors. It’s also important to consider one’s own investment goals and risk tolerance.

Gold Mining Stocks

Gold mining stocks are stocks of companies that are engaged in the production of gold. By buying shares in these companies, investors can gain exposure to the price of gold, as well as the potential for additional returns from the company’s operations and financial performance.

When investing in gold mining stocks, it is important to research the company and its management, financials, and operations. Factors such as the company’s production levels, costs, and reserve levels can affect the stock price. Additionally, the company’s management, financials, and operations can also affect the stock price.

Investing in gold mining stocks can offer leveraged returns compared to investing in physical gold or ETFs as the value of the stock can be influenced not only by the price of gold but also by the company’s performance. However, it’s important to note that gold mining stocks can be more volatile than other forms of gold investment, and their prices may be affected by factors such as changes in commodity prices, regulatory changes, and operational risks.

It’s important to note that not all gold mining stocks are created equal, some companies may have a higher risk profile than others, and some may be more profitable than others. Additionally, gold mining stocks can be affected by the same factors as other mining stocks, such as environmental and social risks, geopolitical risks, and labor strikes, as well as global economy trends.

Gold Futures and Options

Gold futures and options are financial contracts that allow investors to buy or sell gold at a future date at a predetermined price. These contracts are traded on commodity exchanges, such as the COMEX division of the New York Mercantile Exchange (NYMEX) and are used by investors to speculate on the price of gold or to hedge against price fluctuations.

A gold futures contract is an agreement to buy or sell a specified amount of gold at a specific price on a specific date in the future. Futures contracts are used by investors to speculate on the future price of gold, as well as by producers, consumers and merchants who use it to hedge against price fluctuations.

On the other hand, a gold option contract gives the holder the right, but not the obligation, to buy or sell a specified amount of gold at a specific price on or before a specific date in the future. An option to buy is called a call option, while an option to sell is called a put option.

Gold futures and options can be complex investment vehicles and may require specialized knowledge. They are considered high-risk and are not suitable for all investors. It’s important to be aware of the risks associated with gold futures and options, such as the potential for large losses and the need for margin.

Investors who trade in gold futures and options are required to have a margin account with the exchange and deposit a certain amount of money as collateral to ensure that they can meet the obligations of the contract. It’s also important to keep in mind that gold futures and options contracts expire at a specific date and need to be closed before the expiration date to avoid potential losses.

Gold Certificates

These are financial products that represent ownership of a certain amount of gold, it can be physical or paper. The physical ones are typically issued by banks and are backed by the bank’s gold reserves. Paper certificates are issued by mining companies and represent a certain amount of gold in a mining operation, these may not be fully backed by physical gold.

Physical gold certificates are typically issued by banks and are backed by the bank’s gold reserves. They work as a form of paper gold, meaning that the holder of the certificate owns the specified amount of gold, but does not take physical possession of it. Instead, the gold is kept in a secure location, such as a bank vault, and the holder can redeem the certificate for the underlying gold at any time. Physical gold certificates are often used as a way to invest in gold without the need for storage or insurance.

On the other hand, paper gold certificates are issued by mining companies and represent a certain amount of gold in a mining operation. They may not be fully backed by physical gold and are considered a form of unsecured debt. These certificates are not as popular as physical gold certificates, and their value is tied to the mining company’s performance and the gold mining operation’s performance.

When investing in gold certificates, it is important to consider the creditworthiness of the issuer and the underlying gold reserves to ensure that the certificate is fully backed by physical gold. It’s also important to be aware of the risks associated with investing in paper gold certificates, such as the credit risk of the issuer and the operational risk of the mining operation.

Conclusion

Investing in gold can be a great way to diversify a portfolio, potentially protect against inflation, and act as a safe haven asset during times of economic uncertainty. Each type of investment has its own set of risks and benefits, and it’s important to consider factors such as storage and insurance costs, management fees, and volatility when choosing which type of gold investment is right for you.

Before investing in gold, it is important to conduct thorough research and consider one’s own investment goals, risk tolerance, and financial situation before investing in gold. Diversifying the portfolio and not putting all the eggs in one basket is also important. As with any investment, it’s important to keep in mind that past performance is not indicative of future results.