Investing for Beginners: The 10 Best investment Options

When you are just starting out in the investment world, it can be difficult to know where to begin. There are so many investment options available, and it can be tough to decide which ones are right for you. In this blog post, we will discuss the 10 best investment options for beginners. We will provide information on each option, as well as tips on how to get started. So if you are looking to invest your money but don’t know where to start, read on.

Why Invest?

Investing can help you build wealth over time and secure your financial future. It also gives you the opportunity to earn returns on your money that are higher than what you could get with a savings account or other fixed-income investments.

Investing can help you get out of a financial jam, offer you an alternative source of income, and even fund your retirement. Through investing, you can grow your wealth, increase your purchasing power, and meet your financial goals.

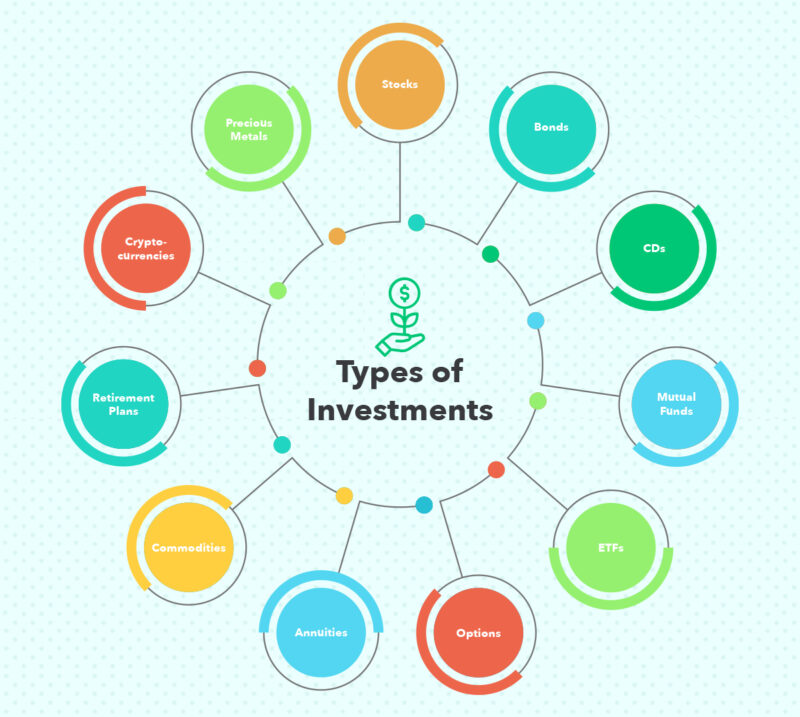

Top Investment Options

Below are the top investment options you can choose from;

High-yield savings accounts

High-yield savings accounts offer a higher rate of return on your investments than traditional savings accounts. The high interest paid allows the account holder to earn passive income from their savings.

These accounts are ideal for short-term savings to achieve specific financial goals. They are good for those who want to put some money aside to be used in the near future. The high-yield savings account is also good for risk-averse investors who want to avoid the risk of not recovering their money.

These accounts are very safe as they are offered by banks that are insured by the Federal Deposit Insurance Corporation (FDIC) hence users don’t have to worry about losing their deposits.

Although they are generally considered a safe form of investment, inflation may eat into your savings and reduce your purchasing power over time.

Certificates of Deposit (CDs)

A certificate of deposit is a type of bank deposit that provides a fixed rate of return over a specified period. CDs are one of the safest investments you can make, as they are insured by the FDIC up to $250,000 per depositor in case the bank should fail.

This makes them an attractive option for investors who want to get higher returns without taking on too much risk. They also provide access to liquidity since they can be withdrawn early with only a few penalties.

When investing in CDs, it’s important to keep your time horizon and financial goals in mind when selecting one. Be sure to read all the terms and conditions before investing so you know exactly what you are getting into.

Mutual Funds

Mutual funds are a type of professionally managed investment that pools money from many investors to buy a portfolio of stocks, bonds, and other securities. They are easy to invest in and provide diversification with relatively low risk.

Investors can choose from different types of mutual funds such as stock, bond or money market funds. Each fund will have its own specific goal and strategy for investing so you’ll want to make sure you understand what each fund is trying to achieve before investing in it.

When selecting a mutual fund, look at the expense ratio (the annual fees associated with the fund) as well as whether it has any minimum balance or purchase requirements. You’ll also want to consider the long-term performance of the fund, as well as its risk profile.

Exchange Traded Funds (ETFs)

ETFs are a type of mutual fund that trades on an exchange like a stock. They provide the same diversification benefits as mutual funds at lower cost since they have no minimum purchase requirements and tend to have lower expense ratios than traditional funds.

When investing in ETFs, it’s important to consider their liquidity and trading costs, as well as any other associated fees. Additionally, you should look at the underlying holdings of the ETF to make sure it is invested in assets that align with your financial goals.

Real Estate Investment Trusts (REITs)

A real estate investment trust (REIT) is an investment fund that owns and operates income-producing real estate properties. REITs offer investors access to a diversified portfolio of passive investments in commercial real estate.

The main benefit of investing in REITs is the potential for higher returns than other types of investments as they are not subject to corporate taxes. Additionally, since REITs generate income through rent payments, they tend to be less volatile than many other investments.

When investing in REITs, it’s important to look at their management fees, operating expenses, and dividend payout rates as well as their historical performance. You should also consider any special tax considerations associated with investing in them before making a decision.

Bonds

Bonds are a type of debt instrument where an investor lends money to an entity, such as a government or corporation, in exchange for the promise of regular interest payments. They are typically considered one of the safest investments, although their returns tend to be relatively low compared to other options.

Investing in bonds can be done either directly or through bond funds. When selecting a bond fund, it’s important to look at its expense ratio and historical performance before investing. Additionally, consider any special tax considerations associated with investing in bonds before making a decision.

Stocks

Stocks are a type of equity investment where investors own shares in publicly traded companies. They offer higher potential returns than most other types of investments but also come with higher risk since they are subject to more price fluctuations.

When selecting stocks, look at the company’s financial performance and fundamentals as well as any special tax considerations associated with investing in them. Additionally, consider whether you want to buy individual stocks or invest in a mutual fund or ETF that holds many different stocks so you can benefit from greater diversification.

Treasury Securities

Treasury securities are government-issued bonds that offer investors a safe and reliable return on their investment. They come in two main types: bills (which mature after a year) and notes (which mature between two and ten years). Investing in Treasury securities is generally considered one of the safest investments since they are backed by the full faith and credit of the U.S. government.

When investing in Treasury securities, consider their maturity dates and any associated fees. Additionally, you should look at their historical performance to determine whether they are a good fit for your investment goals.

Annuities

An annuity is an insurance product that pays out a fixed stream of income over time. They can either be immediate (where the payments begin right away) or deferred (where payments start at a later date). Annuities offer investors the potential for steady income but come with high fees and other costs that can reduce returns.

When selecting an annuity, it’s important to understand its terms and conditions as well as any restrictions or penalties associated with withdrawing money early. Additionally, consider any special tax considerations before making a decision.

S&P 500 index funds

An S&P 500 index fund is a type of mutual fund or ETF that holds the stocks in the widely-tracked Standard & Poor’s 500 Index. These funds offer investors access to a diversified portfolio of large U.S. companies and tend to have lower fees than actively managed funds.

When selecting an S&P 500 index fund, consider its expense ratio and historical performance as well as any special tax considerations associated with investing in them before making a decision. Additionally, look for funds that hold only the stocks in the index (which will ensure you are getting true exposure) rather than those that also include some other investments.

Nasdaq-100 index funds

A Nasdaq-100 index fund is a type of mutual fund or ETF that holds the stocks in the widely-tracked Nasdaq-100 Index. These funds offer investors access to a diversified portfolio of mostly tech and biotech companies, though some other industries are also represented.

When selecting a Nasdaq-100 index fund, consider its expense ratio and historical performance as well as any special tax considerations associated with investing in them before making a decision. Additionally, look for funds that hold only the stocks in the index (which will ensure you are getting true exposure) rather than those that also include some other investments.

Factors to Consider when Selecting an Investment Instrument

No matter which type of investment you choose, there are some important factors to consider before making a decision. Below are factors to consider when deciding investment options to invest your extra cash

Risk Level

Almost all investment options come with some level of risk that an investor needs to know of before deciding where to invest their money. An investor needs to conduct a risk-return analysis, which entails weighing the risks involved in an investment, vis-à-vis the expected returns.

Traditional investments like bank fixed deposits, gold, and saving certificates fetch lower returns but have a lower risk margin.

Listed securities on the other hand have the potential to fetch higher returns compared to traditional investment instruments but they also carry a higher risk.

Liquidity

Liquidity of an investment is important to decide before investing. The liquidity of an investment refers to how easily the investor can convert and withdraw money without incurring a loss in value. Bank Fixed Deposits, Savings Certificates, Provident Funds are all highly liquid investments as they allow for withdrawal at any time or after expiration of the term. Mutual Funds and Stocks on the other hand have varying levels of liquidity depending upon their type.

Cost

The cost associated with an investment option also needs to be taken into account while deciding where to invest your money. An investor should compare the cost associated with different investment options and select one that best suits their needs and budget. While bank fixed deposits come with low cost, mutual funds and stocks come with different levels of cost depending upon their type.

Taxation

The taxation applicable on investment options is also an important factor to consider before investing. Investments like bank fixed deposits, PPF, etc are eligible for tax deductions while others such as capital gains from listed securities are taxed according to the applicable tax slab rate. An investor should look into the taxation aspects associated with each investment option before making a decision.

Volatility

The volatility of an investment refers to the degree of fluctuation in its price. High-risk investments such as stocks are more volatile when compared to other traditional investments like bank fixed deposits. Investors should look into the historical volatility data before deciding which option suits their risk tolerance level.

Rate of Inflation

Inflation rate is an important factor to consider while investing. Inflation reduces the purchasing power of money, which in turn affects the return on investment. For instance, if the inflation rate is higher than the interest rate offered bank fixed deposits, then it might be better to opt for other inflation-proof investments like gold and real estate.

Conclusion

Investing can be daunting for beginners, but with the right research and advice, it can be a great way to grow your money. There are many options available to investors depending on their risk tolerance and goals. As a beginner investor, it is important to understand the different types of investments available and the factors associated with them before making a decision. Taking all these factors into account while investing will help ensure that you choose an instrument that best suits your needs.