Investing in Mutual Funds: The Ultimate Guide

Investing in mutual funds is one of the most popular options for people who want to invest their money. They offer a variety of benefits, including diversification, liquidity, and low fees. In this article, we will discuss all you need to know about mutual funds! We will cover topics such as how to buy mutual funds, the different types of mutual funds available, and the risks and rewards associated with investing in them.

What are Mutual Funds?

Mutual funds are a type of pooled investment vehicle that allows investors to pool their money together and invest in different assets. The fund is managed by an experienced professional who makes decisions about investing in stocks, bonds, and other securities based on the goals of the fund. Investors can choose from different types of mutual funds depending on their risk tolerance and investing goals.

How to Buy Mutual Funds?

Investors can purchase mutual funds either directly or through a broker or financial advisor. If they choose to go with a broker or advisor, they will be charged fees for the advice and services provided. Investors should make sure to research any potential financial advisors before investing with them. You can follow the steps below to invest in mutual funds;

Step 1: Open an Investment Account

In order to invest in mutual funds, you need to first open an investment account from where you can buy the funds. You can open an account through your workplace 401(k) or open through an online broker. You can also engage a professional financial advisor to help to set up your account.

You can open different accounts based on your investment objectives. The various objectives may be retirement or long-term wealth accumulation, saving for your children’s future, and investing in your children’s education.

Step 2: Choose a Mutual Fund Investment Strategy

Your mutual fund investment strategy should specify the percentage of your income which is invested in each mutual fund. This is called asset allocation and it is what determines the size of each investment instrument in the portfolio.

The choice of investment strategy is to a launch extent influenced by one’s age and timeline. For instance, those in their 20s and 30 will invest between 90 percent and 100 percent in stocks and between zero percent and 10 percent in bonds. Those in the 40s may invest 80 percent to 100 percent in stocks and between zero percent and 20 percent in bonds while those in the 50s may invest between 65 percent and 85 percent in stocks and between 15 percent and 35 percent in bonds.

Investors in their 60s may invest between 45 percent and 65 percent in stock, 30 percent and 50 percent in bonds, and keep between zero percent and 20 percent in cash and cash equivalents.

Step 3: Research Mutual Funds

Once you have determined your asset allocation, it’s time to research the different mutual funds. Take some time to understand the different types of mutual funds available in the market such as equity, bond and index funds. Consider investing in a mix of these funds based on your risk appetite and investing goals.

Also determine the type of fund to invest in. There are two main categories of mutual funds – actively managed funds and passively managed funds. Actively managed funds are managed by a portfolio manager or team of fund managers who actively select stocks, bonds and other securities based on their research and investing strategies.

Passively managed funds are also known as index funds and are usually benchmarked to an index like the S&P 500. These funds track the performance of the underlying index and follow a buy-and-hold investing strategy with minimal changes in its holdings.

When researching mutual funds, look for information about the fund’s investment strategy, its past performance, fees associated with the fund and other factors related to investing in that specific fund.

Step 4: Investing in Mutual Funds

Now that you have done all your research it is time to make an actual purchase. You can buy shares directly from any financial institutions such as banks or brokers or through online investing platforms such as Fidelity or Schwab. You should also make sure that you are aware of any fees associated with investing in mutual funds and whether the fund has a minimum investing requirement.

Step 5: Monitor Your Investment

Once you have chosen your mutual funds, it is important to monitor them regularly to ensure that they are performing according to your expectations. If there is underperformance or if new opportunities arise in the market, you might want to consider making changes in your portfolio. It’s also important to know when to take profits and cut losses.

How Are Mutual Funds Priced?

Mutual funds are priced based on their Net Asset Value (NAV). NAV is calculated by taking the value of all the securities in a fund and subtracting its liabilities. The resulting figure is then divided by the total number of shares outstanding to arrive at the NAV per share.

The pricing of mutual funds can vary depending on whether they are open-end or closed-end funds, and whether they have a front-end or back-end load. Front-end loads are sales charges that are taken out when you buy shares while back-end loads are fees charged when you redeem your shares.

The mutual fund’s value is determined by the performance of its purchased securities. Investing in a mutual fund typically involves buying a share of its portfolio value. Unlike stock investors, mutual fund investors do not acquire voting rights from the mutual fund shares held. Investors can invest or redeem their mutual fund shares at the fund’s prevailing NAV.

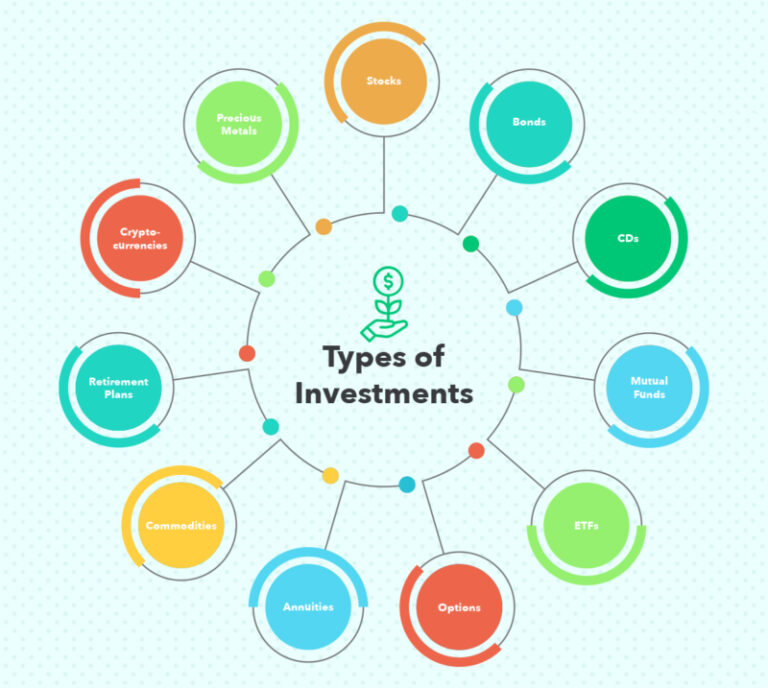

Types of Mutual Funds

Below are the different types of mutual funds;

Stock Funds

Invest primarily in stocks, investing in either a single sector or a variety of sectors. This fund category is comprised of several other subcategories, which are named based on either the size of the company they invest in like small-, mid-, and large-cap or their investment approaches like aggressive growth, income-oriented, value, and others.

When investing in stocks, the mutual fund may opt for shares from high-quality, low-growth companies that have fallen out of market favour. This is investment strategy is called value fund. The strategy involves selecting companies with low price-to-book (P/B) ratios, low price-to-earnings (P/E) ratios, and high dividend yields.

Large –cap companies are those with high market capitalizations with a market size of over $10 billion. These are usually blue-chip companies that are easy to recognize by their names. On the other hand, small-cap stocks are those with a relatively low market capitalization and are valued at between $250 million and $2 billion. These stocks often carry more risk but can offer higher potential returns.

Bond Funds

Invest primarily in fixed-income investing, investing in a variety of bonds such as government, municipal and corporate bonds. Bond funds may focus on the investment grade debt or pursue high-yield securities for higher returns.

A fixed-income mutual fund generates a minimum return periodically for its investors. This type of fund mainly targets investment products that pay a fixed rate of return. Such types of investment vehicles may include corporate bonds and government bonds among other debt instruments.

Bond funds are usually actively managed and mainly invest in undervalued bonds before selling them at a profit. These funds usually pay higher returns compared to ordinary stocks.

Money Market Funds

Invest primarily in short term and low-risk debt instruments. Money market funds offer higher returns than traditional bank accounts, while still investing in investments that are highly liquid.

A money market fund is a type of mutual fund investing in short-term and high-quality debt instruments such as treasury bills, certificates of deposit (CDs), and commercial paper. These funds are relatively safe investments since they are investing in short-term securities with high credit ratings. They also tend to pay an attractive yield compared to other types of fixed income securities.

Index Funds

Invest primarily in a portfolio of securities that track an index such as the S&P 500. Index funds are low-cost, passive investing strategies that provide investors with broad exposure to the stock market without having to pick individual stocks.

Index funds are portfolios of securities that track an index like the S&P 500 or Nasdaq Composite. The objective of investing in these funds is to replicate the performance of its underlying benchmark index, while allowing investors to gain diversified exposure to different stocks at a relatively lower cost than investing in individual stocks. These funds are usually passively managed and require lower management fees compared to actively managed mutual funds.

Income Funds

Invest primarily in income-producing securities such as dividend stocks and high-yield bonds. Income funds tend to focus on investing in stocks that offer stable and consistent dividends over the long term, while investing in higher risk bonds for higher yields.

Income funds are investment vehicles that invest in a variety of income producing securities such as dividend paying stocks and high-yield bonds. They provide investors with the opportunity to generate a steady stream of income from their investments, while still investing in relatively safe and low-risk securities. These funds often have lower volatility than investing solely in individual stocks since they are investing in a diversified portfolio of different securities.

International/Global Funds

Invest in a wide range of companies or securities from multiple countries. This type of investing allows investors to diversify their portfolios by investing in global markets and potentially lower their overall risk profile.

International/Global funds are mutual funds that invest in a variety of securities from different countries around the world. These funds provide investors with exposure to different currencies, markets, and economies while also offering diversification benefits compared to investing solely in domestic stocks.

Investing internationally can also open up opportunities for higher returns due to the potential for higher growth rates in certain emerging markets. However, investing globally may also carry additional risks compared to investing exclusively in domestic stocks, such as currency fluctuations and political risks.

Specialty Funds

Invest in a specific sector or asset type such as real estate, commodities, or precious metals. Specialty funds can provide investors with the opportunity to gain exposure to niche investing strategies and potentially higher returns than investing solely in stocks and bonds.

Specialty funds are mutual funds that invest in a particular sector or asset class that may be difficult for individual investors to access on their own. These funds provide investors with exposure to different investing strategies that may offer higher potential returns compared to investing exclusively in stocks and bonds. However, there is also the risk of investing in highly specialized investments that could have greater volatility than more traditional investments like stocks and bonds.

Exchange Traded Funds (ETFs)

Invest in a portfolio of underlying securities that can be bought and sold on an exchange, similar to stocks. ETFs are passive investing strategies that generally have lower fees than actively managed funds while providing access to different markets or asset classes.

Exchange Traded Funds (ETFs) are investment vehicles that track a broad range of indices, sectors or investing themes. Like index funds, they provide investors with a low-cost way to gain diversified exposure to the stock market without having to pick individual stocks. ETFs can also offer more flexibility and liquidity compared to investing in mutual funds since they trade like stocks on exchanges throughout the day. They also tend to have lower management fees than actively managed mutual funds making them more cost-effective for investors.

Advantages of Investing in Mutual Funds

Research shows close to half of U.S. households have investments in mutual funds. Below are the advantages of investing in mutual funds;

Diversification

Mutual funds allow investors to diversify their portfolios by investing in a variety of different securities and asset classes, reducing the overall risk profile of their investments.

In investment, diversification means mixing different assets and investment instruments in a portfolio with the main objective being to minimize risks. Mutual funds usually invest their members’ funds in different industries, and securities with different capitalizations. This helps to balance the portfolio, thus reducing its vulnerability to stock market fluctuations.

Professional Management

Mutual funds are professionally managed by experienced fund managers who have access to a wide range of investing strategies and resources.

Professional fund managers are better equipped than individual investors when it comes to investing in securities like stocks and bonds. They have access to more investing information, more research capabilities, and can make decisions with fewer emotions involved. This allows them to maximize returns while minimizing risks for their investors.

Low Costs

Investing in mutual funds is generally cheaper than investing directly in individual stocks or other securities due to economies of scale and lower management fees.

Mutual Funds typically charge lower management fees compared to investing in individual stocks or bonds. This is because mutual funds can take advantage of economies of scale due to the large pool of investors that are investing in the fund. Additionally, investing in a mutual fund will also save you time and money in researching and monitoring individual securities.

Liquidity

Mutual funds have high liquidity as investors can easily buy and sell their shares on the open market.

Mutual Funds are considered liquid investments since they can be bought and sold relatively quickly on the open market. This means investors can access their money any time without having to wait for extended periods like with some alternative investments such Real Estate or Precious Metals.

Low Minimums

Mutual funds typically require relatively low minimum investments.

Mutual Funds generally have very low minimum investment requirements, allowing investors to get into the investing game with a small sum of money. This makes mutual funds an ideal investing option for those who don’t have large amounts of money to invest but are still looking for diversified portfolios and professional management.

Tax Efficiency

Mutual funds are generally more tax efficient than investing directly in individual stocks since they can generate capital gains or dividends which may be taxed at lower rates than investing directly in individual stocks or bonds.

Disadvantages of Investing in Mutual Funds

Although investing in mutual funds has several advantages, there are some drawbacks to consider.

No Control Over Investment Choices

Mutual fund investors have no control over what securities the fund will invest in and when to buy or sell them.

Mutual Funds are professionally managed by experienced fund managers who make all investing decisions regarding the security selection and timing of trades. As an investor in a mutual fund, you do not have any say over how your money is invested which can be a drawback for those who like to have more control over their investments.

High Expense Ratio

Most mutual funds charge yearly management fees known as “expense ratios” which can vary from as low as 0.25% to as high as 2.5% of the fund’s assets under management.

High expense ratios can reduce an investor’s returns, so it is important to consider these fees when investing in mutual funds.

No Guaranteed Returns

Mutual Funds carry no guarantee of investment return and are subject to market fluctuations which can lead to losses in capital invested. Therefore, investing in mutual funds should be done with caution and awareness that there is a potential for loss of invested capital.

Cash Drag

A mutual fund’s cash drag can be a disadvantage for investors who are investing in the fund with the expectation of higher returns.

Cash drag is when a mutual fund has uninvested cash that is not being put to use and thus not generating an income or return. Mutual funds keep a portion of members’ contributions in liquid cash in order to maintain liquidity and accommodate withdrawals. This reduces the potential returns that an investor could have received if all the money were invested.

Conclusion

Investing in mutual funds can be a great way to diversify your portfolio and take advantage of professional investing experience without having to manage investments yourself. However, it is important to understand the potential risks and disadvantages associated with investing in mutual funds, such as high expenses, lack of control over investment decisions, and no guaranteed returns.