US fund managers shift investments to international markets as Europe and China outperform

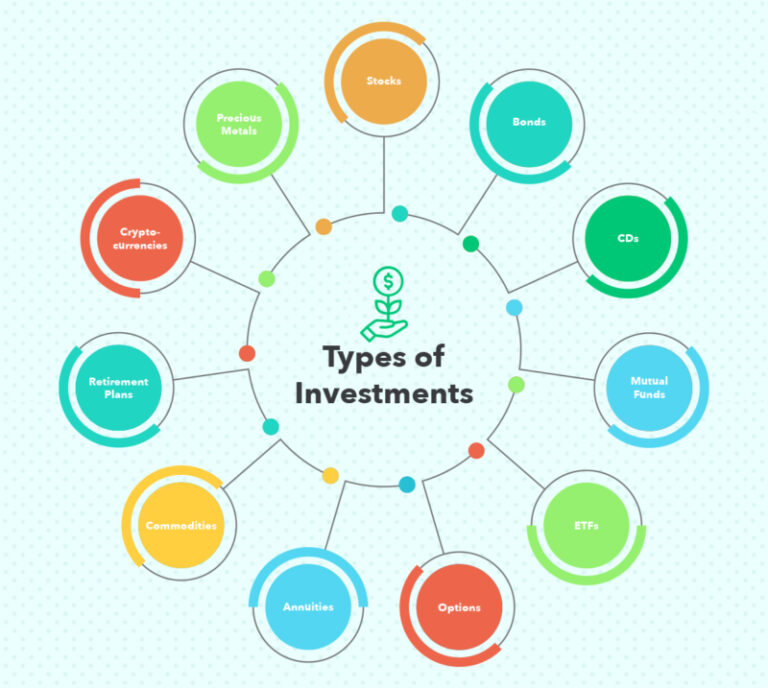

US investors and fund managers are expanding their investments in international stock markets as concerns about a potential economic slowdown and increasing interest rates have put an end to over a decade of domestic market dominance.

Since the financial crisis, US stocks have significantly outperformed most developed and emerging markets.

However, this trend began to reverse last year.

Europe’s Stoxx 600 index has recorded stronger returns than the S&P 500 on Wall Street for four consecutive quarters, marking its longest outperformance period since 2008.

Although European stocks did suffer a decline in the middle of last year, the losses were not as severe as those in the US.

As a result, US investors and asset managers who relied on the US growth trend have recognized the importance of diversification.

“If you look at the distribution of our asset management, we have a large concentration in the active US equity space,” said Rob Sharps, chief executive of T Rowe Price, the $1.3tn fund group know for its active management.

“It’s what we’re known for, but it’s also a part of the market that is losing share.”

Sharps mentioned that T Rowe is focusing on enhancing its proficiency in global equities and international fixed income.

e also expressed his interest in expanding into these asset classes, even though the company is recognized for its strengths in active US equity.

According to the BlackRock Investment Institute, US equities are projected to have lower performance than stocks in emerging markets, Europe, and China in the forthcoming decades.

However, the outlook for China varies significantly across a broad range of potential outcomes.

PineBridge Investments, a fund manager with $143bn in assets, has taken a “more cautious stance on broader US stocks” according to their latest strategy note.

This is due to concerns about overvaluation, tightening credit, and increased risk aversion by banks, as well as the Federal Reserve’s withdrawal of bond market support.

On the other hand, the note expresses a more optimistic outlook on emerging markets such as China and India.

EPFR data shows that investors have withdrawn $34 billion from US equity funds in the current year, while Europe has experienced inflows of $10 billion.

Despite the US having the largest stock market in the world, with the market capitalization of the S&P 500 reaching $34tn, compared to just under €10tn on the Euro Stoxx 600, macroeconomic factors and differences in market structure are prompting a shift.

Over the past decade, US dominance was driven by large tech groups, which have been affected adversely as rising interest rates decrease the relative attractiveness of long-term growth assets.

In contrast, European stock market indices have a greater emphasis on industries such as financial services and commodities, which are less impacted by high interest rates.

At the same time, the European economy received support from a mild winter, enabling it to perform better than anticipated by most economists and recover robustly from the previous year’s energy crisis.

On the other hand, Chinese equities funds have witnessed inflows of almost $16bn in Asia, thanks to the reopening of Beijing after years of strict COVID-19 measures.

This reopening has also supported Europe, which relies more on exports to China than the US.

EPFR data shows that almost $34bn has flowed out of US equities funds this year, and China accounted for nearly half of the $34bn inflows into emerging markets.

The Colony Group’s Senior Portfolio Manager, Frank Brochin, said that investors are beginning to see China as an attractive investment opportunity again.

According to Brochin, the growing investment acumen of institutions such as charitable foundations, endowments, and family offices is likely to provide a long-term lift to US investments in foreign markets.

However, he added that this trend could benefit local companies more than US fund managers.

“We [mainly] use local managers because they have a depth of knowledge and understanding of those markets which is hard to reproduce,” he said.