Wall Street Banks Likely to Experience More Pressure after Crisis

Wall Street banks are anticipated to report reduced quarterly earnings and a gloomy outlook for the rest of the year due to the negative effects of last month’s regional bank crisis and a slowing economy on their profitability.

According to a Reuters’ report, the earnings per share for the six largest U.S. banks are projected to decrease by approximately 10% compared to the previous year.

The banks are scheduled to release their results on April 14.

Analysts say larger Wall Street banks benefited from a surge in access to affordable deposits as customers fled smaller lenders following Silicon Valley Bank’s collapse last month.

This surge is expected to have increased the net interest income for the biggest banks.

According to analysts, JPMorgan Chase & Co (NYSE: JPM), the biggest U.S. bank, is expected to outperform its peers due to its higher net interest margin – the difference between the interest earned on loans and the interest paid to depositors.

According to Reuters calculations, the bank is predicted to announce a 30% boost in EPS, fueled by a nearly 36% surge in net interest income.

“We expect a challenging earnings season for the banks,” said David Chiaverini, banking analyst at Wedbush Securities, in a note.

He noted that bank managements will adopt a more defensive approach and put in place liquidity measures that may result in a decrease in net interest income due to downward revisions.

Another slump in deals and capital markets activity is expected to have an adverse impact on profits, with some analysts forecasting a deceleration in trading revenue too.

These trends would particularly affect investment banking giants such as Goldman Sachs Group Inc (NYSE: GS) and Morgan Stanley (NYSE: MS).

According to analysts, trading income, which served as a bright spot in prior quarters, could experience a decline in equities trading during the first quarter compared to the previous year.

However, the strength in fixed-income, currencies, and commodities (FICC) may partially offset this decline.

Goldman Sachs‘ earnings per share may drop by 20%, affected by problems in investment banking, following a larger than predicted 69% decline in fourth-quarter profit, driven by revenue losses in wealth management and consumer businesses.

The six banks have not commented on upcoming results and forecasts.

The S&P 500 (INDEXSP: .INX) bank index has dropped by 14% year-to-date.

Source: Reuters

When interest rates increase, banks earn a higher amount on interest payments from borrowers than what they pay out to depositors.

According to Reuter analyst projections, the net interest income of the six largest U.S. banks is expected to increase by approximately 30% from the previous year.

Despite gains from interest payments, bad loans could counteract these gains.

“There will still be incremental increases in provisions coming in this year,” particularly for commercial real estate and potentially consumer credit cards, said Ana Arsov, head of the North American banking team at rating agency Moody’s Investors Service.

She says a lending deceleration is expected in sectors like commercial and industrial, automobile, and mortgage.

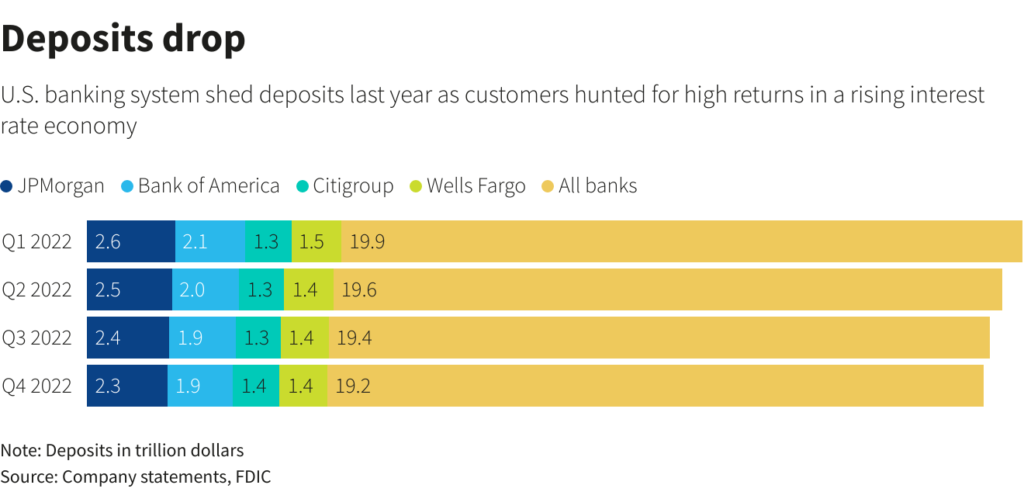

Investors will closely examine balance sheets to identify which lenders gained or lost deposits during the March banking crisis and evaluate its impact on lending and the economy of the United States.

The outcomes will provide a glimpse of how easily lenders can finance their operations and whether they possess adequate reserves to withstand unforeseen circumstances.

“The fears over bank capital and liquidity levels are likely to persist for at least the next few months because of the recent stresses,” Gennadiy Goldberg, U.S. interest rate strategist at TD Securities, said in an interview.