10 Best Mutual Funds of 2023

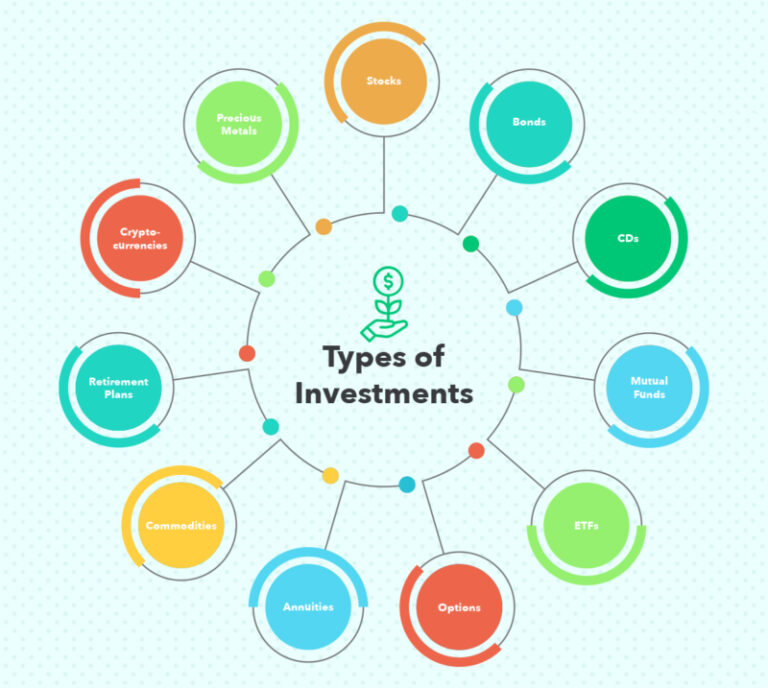

When it comes to choosing the best mutual funds to invest in, there are a lot of things to consider. Each investor is different, and each mutual fund has its own set of risks and rewards. That being said, there are some mutual funds that are better than others, and we have compiled a list of the 10 best mutual funds to invest in for 2023.

Factors to Consider when Selecting a Mutual Fund

The mutual fund landscape is a crowded one with thousands of players in the market. This calls for due diligence when selecting a mutual fund to invest in. Below are factors to consider when vetting different funds for investment.

Fund Performance

One of the most important factors to consider when selecting a mutual fund is its performance over a period of time. You want to invest in funds that have consistently produced returns above the market index or benchmark.

Before putting your hard-earned cash in a fund, do some research to determine the fund’s overall performance and if it aligns with your investment goals and objectives.

Fund Manager’s Reputation

You should also do some research on the fund manager and their track record of success. The best fund managers have a proven track record of producing positive returns for investors over the long-term.

Investing in an experienced, reputable fund manager can provide you with added confidence that your investment is in good hands.

Expense Ratio

Another factor to consider when selecting a mutual fund is its expense ratio. This measure indicates how much an investor pays annually as a percentage of their total investments to cover administrative costs associated with running the fund.

You want to select funds with lower expense ratios as they will leave more money in your pocket and maximize your potential returns.

Fund Costs

Mutual fund costs can vary widely, so you want to select funds that have lower expenses. In general, no-load funds tend to be the least expensive mutual fund option.

The 10 Best Mutual Funds for 2023

Below are the top 10 best mutual funds in 2023;

Shelton Nasdaq-100 Index Direct (NASDX)

The Shelton Nasdaq-100 Index Direct (NASDX) fund seeks to replicate the performance of the largest non-financial companies on the Nasdaq-100 Index®. The Fund is passively managed and its investment strategy involves buying stocks until its holdings in the company or portfolio approximate those of the Nasdaq-100 Index.

The Nasdaq-100 Index® lists the top 100 local and international non-financial companies on the Nasdaq Stock Market. The companies are listed based on their market capitalization.

This fund tracks the Nasdaq-100 Index and provides exposure to company’s large technology, biomedical, and financial services companies. The expense ratio is 0.10% and it has posted an average return of 8.79%.

American Funds Growth Fund of America (AGTHX)

The American Funds Growth Fund of America (AGTHX) is an actively managed fund that seeks long-term capital appreciation by investing in a diversified portfolio of domestic and foreign stocks. The fund invests primarily in the common stocks of large, well-established companies with attractive long-term prospects.

This fund has posted an average return of 11.06% over the past five years and its expense ratio is 0.72%. The fund’s objective is to achieve higher returns than those provided by traditional index funds or securities markets generally.

Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

The Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) seeks to track the performance of the CRSP US Total Market Index. The fund invests in a broadly diversified portfolio of stocks that covers the entire U.S. stock market, including large-cap, mid-cap and small-cap stocks.

This fund has posted an average return of 8.86% over the past five years and its expense ratio is 0.04%. The fund’s objective is to provide investors with a low-cost way to gain exposure to the entire U.S. stock market in one mutual fund investment vehicle.

Fidelity 500 Index Fund (FXAIX)

The Fidelity 500 Index Fund (FXAIX) seeks to provide investment results that correspond generally to the performance of the S&P 500® Index. The fund invests in stocks included in the Index, which measures the performance of large-capitalization companies in leading industries of the U.S. economy.

This fund has posted an average return of 10.41% over the past five years and its expense ratio is 0.015%. The fund’s objective is to provide investors with a low-cost way to gain broad diversification across U.S. stocks with access to some of the largest companies in America.

Voya Russell Large Cap Growth Index Fund (IRLNX)

The Voya Russell Large Cap Growth Index Fund (IRLNX) seeks to provide investment results that correspond generally to the performance of the FTSE Russell 1000® Growth Index. The fund invests in stocks included in the index, which measures the performance of large-cap growth stocks within the U.S. equity market.

This fund has posted an average return of 11.87% over the past five years and its expense ratio is 0.15%. The fund’s objective is to provide investors with access to some of the most recognizable companies in America through a low-cost, diversified portfolio of large-cap growth stocks.

JP Morgan Income Fund (JGIAX)

The JP Morgan Income Fund (JGIAX) seeks to provide current income and capital appreciation. The fund invests primarily in equity securities, including common stocks, REITs, and foreign stocks. It also may invest in debt securities, such as corporate bonds and treasury notes.

This fund has posted an average return of 10.11% over the past five years and its expense ratio is 0.54%. The fund’s objective is to provide investors with a relatively low-risk way to income from equity investments while potentially achieving modest capital appreciation.

T. Rowe Price Blue Chip Growth Fund (TRBCX)

The T. Rowe Price Blue Chip Growth Fund (TRBCX) seeks long-term growth of capital by investing in large-cap, blue chip companies with the potential for above-average earnings and dividend growth. The fund invests primarily in common stocks and may also invest in foreign securities.

This fund has posted an average return of 10.86% over the past five years and its expense ratio is 0.78%. The fund’s objective is to provide investors with a low cost way to gain exposure to some of the largest and most successful companies in America while potentially achieving significant long-term capital appreciation.

Dodge & Cox Stock Fund (DODGX)

The Dodge & Cox Stock Fund (DODGX) seeks long term growth through its investments in common stocks. The fund invests in companies of all sizes, with its primary focus on large-cap and mid-cap stocks.

This fund has posted an average return of 9.32% over the past five years and its expense ratio is 0.52%. The fund’s objective is to provide investors with a diversified portfolio of U.S. stocks that offers moderate risk and long-term capital appreciation potential.

Vanguard Wellington Fund (VWELX)

The Vanguard Wellington Fund (VWELX) seeks to provide long-term growth of capital through a combination of income and capital appreciation. The fund invests primarily in stocks and bonds, with an emphasis on stocks. It may also invest in other investments, including foreign securities and REITs.

This fund has posted an average return of 8.75% over the past five years and its expense ratio is 0.25%. The fund’s objective is to provide investors with a balanced portfolio that offers diversification across asset classes while offering the potential for modest growth of capital.

Fidelity Freedom 2030 Fund (FFFHX)

The Fidelity Freedom 2030 Fund (FFFHX) seeks to provide long-term growth of capital by investing in a mix of stocks, bonds and other investments. The fund invests primarily in U.S. and foreign securities, including REITs and ETFs, with an emphasis on large-cap stocks.

This fund has posted an average return of 8.60% over the past five years and its expense ratio is 0.42%. The fund’s objective is to provide investors with access to diversified holdings while offering the potential for capital appreciation as well as income from dividend payments.

Final Word

These are some of the best mutual funds to invest in for 2023. While no investment is without risk, these funds offer potential long-term gains while providing investors with a diversified portfolio and low expenses. As always, it’s important to do your own research before investing any money into any fund or securities.