How to Invest in Stock: Quick-Start Guide for Beginners

It’s been a wild ride lately on the stock market, with indexes going up and down seemingly at will. The U.S. stock market closed out May essentially unchanged from where it started, a feat made possible only due to a strong month-end surge. As we roll out of June, the main U.S. stock indexes have all flirted to bear markets.

Meanwhile, the market appears to be more concerned about economic growth than inflation, which may be plateauing, given that the Federal Reserve has pledged to keep raising interest rates.

So what does all this mean for beginners looking to invest in stocks? Historically, stock investment has outperformed many other assets, making them a potent tool for wealth-building. But with great potential rewards come significant risks.

This guide will help you understand the basics of how to invest in stock to navigate these choppy waters.

Investing in Stocks Explained

A stock is a share of ownership in a company. When you buy stocks, you become a shareholder, and your goal is to make money from the company’s success. When a company does well, its stock price increases, and shareholders make money. There are two main ways to make money from stocks:

- Dividends are a payment made to shareholders from the company’s profits. Not all companies pay dividends, but it’s a way to make money even if the stock price doesn’t go up for those that do.

- Capital gains: This is when you sell your shares for more than you paid for them. For example, let’s say you buy a stock for $100, which goes up to $150. If you sell it at $150, you’ve made a $50 profit or a 50% return on your investment.

The stock market is a long-term endeavor. The best action is to maintain your investing position despite market ups and downs and diversify your portfolio.

Diversification is key because it helps mitigate risk. When you diversify, you spread your money among different investments, which lessens the blow if one investment underperforms.

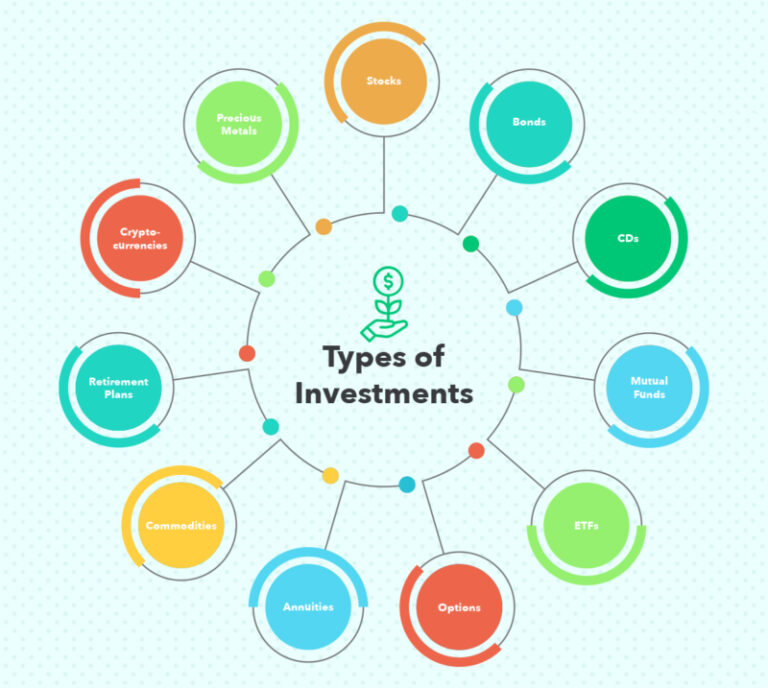

Various Stock Investment Methods

You can invest in stocks in different ways. However, your investment objectives and level of portfolio management involvement will determine how you purchase stocks.

- Individual stocks: You can buy stocks individually, giving you more control over your investment and exposing you to more risk. If you’re starting and have a small sum of money, you can consider purchasing fractional shares even though some corporations’ share prices appear pretty high. This is an excellent option if you want to carefully select which companies you invest in and actively manage your portfolio.

- Stock ETFs: Investing in Exchange-traded funds (ETFs), is similar to purchasing stocks from a huge variety of businesses that belong to the same industry or are part of an S&P 500-style stock index. For example, if you’re bullish about the tech industry’s future, you can purchase an ETF that tracks the sector. So, compared to owning a single stock, ETF shares offer greater diversification and are traded on exchanges like stocks.

- Stock mutual funds: ETFs and mutual funds have certain similarities but also significant differences. Active mutual fund managers choose various stocks to beat a benchmark index. Your benefits from investing in stock mutual funds come from dividends, interest, and capital gains. Index funds with lower fees are mutual funds that function more like ETFs.

When it comes to picking stocks, there’s no one-size-fits-all approach. It ultimately depends on your investment goals and risk tolerance.

How to Invest in Stocks

Here’s a quick-start guide on how to begin investing in stocks:

Step One: Determine Your Investment Goals

It’s critical to understand your primary goals for investing in stocks. Do you want to build wealth over the long term? Are you looking to generate income? Are you trying to protect your capital? Or are you trying to build your nest egg for retirement?

Your investment objectives will guide your decision-making and help you select the best stocks for your portfolio.

Remember, investing in stocks is inherently risky, and you should only invest money you’re comfortable with losing. You may want to consider your risk appetite for your financial and mental well-being. This is typically called “risk tolerance,” or how much risk you can realistically accept, given your financial situation and feelings towards risk.

Step Two: Choose How you Want to Invest

Select a method that aligns with how much effort and guidance you’d like to invest in managing your investments. When it comes to investing, you now have a variety of options:

- Set up a brokerage account– You can register an online brokerage account and purchase stocks if you have a basic understanding of investing. With a brokerage account, you have complete control over the selection and acquisition of stocks.

- Get a robo-advisor– A quick and inexpensive option to buy stocks is through robo-advisors. Most robo-advisors put your money in various ETF portfolios and manage your account for you by purchasing the assets. Though they are frequently less expensive than financial consultants, you rarely get the benefit of a live person to assist you with decisions and provide answers to your inquiries.

- Get a financial advisor– Consider hiring a financial advisor if you’d like more suggestions and direction for stock purchases and other financial goals. A financial advisor works with you to identify your financial objectives and then buys and manages your investments on your behalf, including stock purchases. In exchange for their services, financial advisors may charge a flat annual fee, a fee for each trade, or a portion of the assets they manage.

It’s essential to pay attention to fees and ratios when deciding how to invest. These costs will impact your returns over time, so make sure you understand what you’re being charged.

Step Three: Open an Investment Account

Once you decide how you want to invest, it’s time to open an investment account.

For buying stocks, you’ll need a brokerage account. The best brokerage accounts are with online brokerages that offer a wide range of features, low fees, and no account minimums.

If you’re working with a financial advisor, they may suggest opening an account with the firm they work for. A financial advisor can help you stick to your investing goals and recommend individual stock purchases.

A robo-advisor can create a stock portfolio that considers your time horizon and risk tolerance. Some robo-advisors, like Wealthfront and Betterment, do not have account minimums.

You can buy stocks using different account types. Some of these investment accounts are available through the abovementioned methods, while others can only be obtained through your workplace.

- Taxable investment accounts– Stock investment gains are classified as regular income and do not receive any special tax treatment when made in taxable investment accounts. Aside from that, there are no contribution limits. This makes taxable investment accounts the best choice for long-term investors since you can take advantage of compounding returns.

- Retirement accounts– With a retirement account, you can take advantage of tax breaks on your contributions and earnings. The most common retirement accounts are 401(k)s and IRAs. Anybody can open the latter via an internet brokerage or robo-advisor, whilst the former is only accessible through an employer. These accounts frequently provide tax benefits that encourage retirement savings but also have yearly contribution limits.

- Education– 529 plans are investment accounts that can be used to cover higher education costs. These plans have tax advantages and may provide other benefits, such as matching contributions from your state.

Step Four: Set a Budget for Stock Purchases

How much money do you want to invest in stocks? This is an essential question since it will help you determine how many shares to buy.

Have we stated that most financial experts prefer you to invest through funds? If you have a long time horizon, you can dedicate a sizable amount of your portfolio to stock funds.

On the other hand, if you’re nearing retirement, you’ll want to be more conservative with your stock choices.

It’s essential to remember that you can continually reinvest your profits and dividends to buy more shares. This process is known as dollar-cost averaging, and it’s an excellent way to build your position over time without having to come up with a large sum of money all at once.

Create a Schedule for Portfolio Reviews.

Once you’ve started designing a portfolio of stocks, you should set up a routine to monitor your holdings and, if necessary, rebalance them.

By using a mix of equities appropriate for your risk tolerance and financial objectives, rebalancing helps guarantee that your portfolio remains balanced. Regular check-ins will assist you in making incremental trades to keep your portfolio in order because market fluctuations might imbalance your asset mix.

There’s no need to check on your portfolio daily; a monthly or quarterly plan is a reasonable cadence. You can even set up calendar reminders to help you stay on track.

Final Thoughts

Investing in stocks is a long-term effort that can result in significant rewards.

By following the steps above and staying disciplined with your investment strategy, you’ll become a successful stock investor. Remember to start small, and don’t get discouraged if your portfolio doesn’t immediately take off. With time, consistency, and a little research, you’ll be well on reaching your financial goals.

Happy investing!