Rising Interest Rates: What Does This Mean For Personal Loans?

The Federal Reserve announced a 0.75% increase in the target range for the federal funds rate on the 15th of June 2022. This means that consumers can expect an increase in interest rates across all types of loans including personal loans over the coming year.

Market analysts largely anticipated the hike, but it still comes as a shock to many consumers already struggling with the rising cost of living. Gas prices, groceries, and other necessities have all been on the rise in recent months, and now those same consumers will have to contend with higher interest rates on their personal loans.

In an effort to slow inflation, home mortgages, credit card borrowing, vehicle loans, labor market stability, and total consumption will get affected by the Federal Reserve’s decision. The objective is to reduce the amount of money in circulation.

“Too much money devalues money,” said Larry Harris, a finance professor at USC Marshall School of Business and former head economist at the Securities and Exchange Commission. “The Fed must cease printing money to keep inflation under control. Interest rates tend to climb when the government stops producing money.”

The Federal Reserve does not set interest rates on credit cards, mortgages, or personal loans but manages the federal funds rate. This is the base rate at which banks lend and borrow money. Consumer interest rates rise in lockstep with this.

How Will Rising Interest Rates Affect Personal Loans?

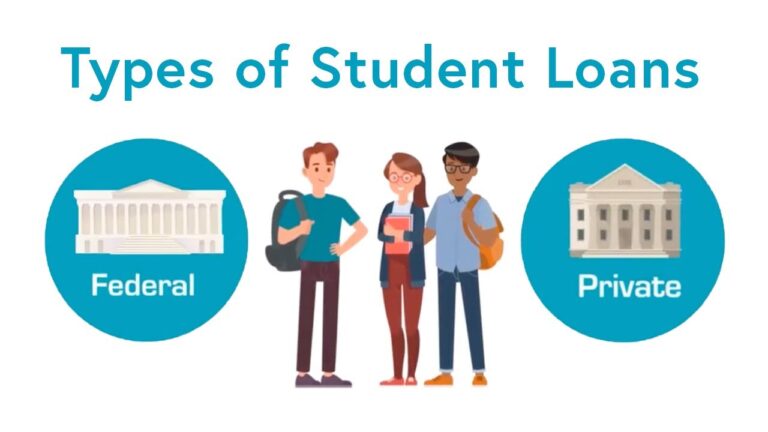

Rising interest rates will have different implications depending on your personal loan type. Let’s take an indepth look:

- Fixed-Rate Loans

A fixed-rate loan offers protection from rising rates because the interest rate is locked in for the life of the loan. Because your loan payment is determined partly by the interest rate, your monthly payment will stay consistent throughout the loan term.

When you lock in an interest rate for a personal loan, you preserve your loan from future interest rate rises by your lender. So if you have any existing fixed-rate personal loans, the Federal Reserve raising its interest rate should not influence your rate or affect your loan in any manner.

- Variable-Rate Loans

A variable-rate loan, on the other hand, will become more expensive as rates increase. If you have a variable-rate personal loan, your monthly payments could go up if the Federal Reserve raises interest rates.

A variable-rate can change over time and is often based on an index, such as the prime rate. Many variable-rate loans allow borrowers to convert to a fixed-rate loan at any time.

If you have a variable-rate personal loan, do the math to determine if shifting your amount to a fixed-rate debt consolidation loan will make sense. Considering this option may be a good idea, as it will protect you from future rate hikes.

According to Harry Zhu, senior vice president and a chief retail lending officer at Alliant Credit Union, personal loan rates will rise, especially if the Federal Reserve raises the federal funds rate numerous times this year.

How Will Hiking Interest Rates Affect New Personal Loans?

The average personal loan rate is currently between 4.49% and 35.99%, but this will likely increase in the wake of the Fed’s rate hike. While higher interest rates will not affect your current fixed-rate loans, they may impact new loans.

If you’re planning to get a personal loan soon, you may save money on interest by locking in a lower rate before further rate rises are projected later this year.

Many lenders use the federal funds rate to determine their prime rate, which is the rate they provide to the most eligible borrowers. Banks and financial institutions often add 3% to the federal funds rate when determining the prime rate for their lending products.

Following the Fed’s pronouncement, the federal funds target rate range is now 0.75 percent to 1%. As a result, U.S. banks have announced prime rate rises to 4% from 3.5 percent before the hike, which might directly influence new loan interest rates. If the Federal Reserve keeps raising rates, personal loan customers may expect higher rates.

Is it the Right Moment to Take a Personal Loan?

Personal loan rates are currently at historic lows; if you have good credit, you may be able to take advantage of these low rates. Since the pandemic’s beginning, personal loan rates have been quite low, and even modest rises can significantly affect the amount of interest you pay in the end.

According to Zhu, taking out a personal loan currently makes sense because of the increasing rate environment. “I think it’s a good idea to lock in a pretty low rate if you take a personal loan,” he adds.

How Can You Manage Rising Interest Rates?

If the Fed takes more measures to control inflation, you can expect higher interest rates on new personal loans.

To manage this, you can:

- Get a debt consolidation loan- If you have strong credit, you may be able to get a debt consolidation loan with a lower interest rate than your credit card’s APR (APR). In this scenario, a debt consolidation loan might help you save money on interest, cut your monthly payment, and perhaps pay off your debt faster.

- Consider a fixed-rate loan– A fixed-rate loan will have the same interest rate for the life of the loan. If you’re worried about rates going up, this loan gives you the peace of mind of knowing your monthly payment will stay the same.

- Get a shorter repayment term– A shorter repayment term will have a higher monthly payment, but you’ll pay less in interest over the life of the loan. Choosing the shortest payback term with the smallest monthly payments possible may result in a reduced interest rate and a shorter loan repayment period.

- Make extra payments– If you have a variable-rate loan, making additional payments can help you pay off your debt faster and reduce the amount of interest you pay over the life of the loan.

Final Thoughts

With the Federal Reserve raising interest rates, now is an excellent time to reevaluate your personal financial situation and make sure you’re on track. If you’re considering taking out a personal loan, shop around and compare offers from multiple lenders to get the best rate.

Keep in mind that the interest rate is just one factor to consider when taking out a personal loan. Make sure to compare terms, fees, and repayment options to find the loan that best meets your needs.